This is the second blog of a 3-part series on International Sales. The first part dealt with the preparations for making an international travel – https://nowhereperspectives.com/2020/06/23/international-sales-preparations-for-a-business-trip/?fbclid=IwAR1KMmN2KSC-7V2hvTUBwcysa92GIINnfFCrslaMt0TuvXi68wcwVPklHrM – and in this edition, I will try to explain the ways to start business in a virgin market. The job of hunting for and getting a business partner, who can be an importer-distributor of your product or a local business partner, starts at the very moment you land in the target-country. Immigration procedure, easiness in collecting baggage and getting out of airport, quality of roads and traffic, etc. give cues to the country you landed in. Imagine that you have scheduled to spend a week in a country to complete the task at hand, and that means you have five days comprising 40 hours to interact with potential partners before you wind up the trip. It is better to arrive in a country on Saturday, especially if the flight is of long haul, as you get Sunday to rest and recoup so that you will be afresh to start working from Monday. This blog has two components: Understanding New Market and Tackling New Market.

Understanding New Market: Before we get into the task of tackling a new market, it is imperative to understand the market in terms of the product that one wants to sell as well as the price-market dynamics. I developed a simple model to understand this dynamics and named it as Pyramid Model for Market Understanding, or PMMU. The model has three elements: General Product Classification, Market Segmentation and Demand Quantification. I am in the business of marketing perfumes in international markets, hence, using perfume as the specimen product to illustrate the model.

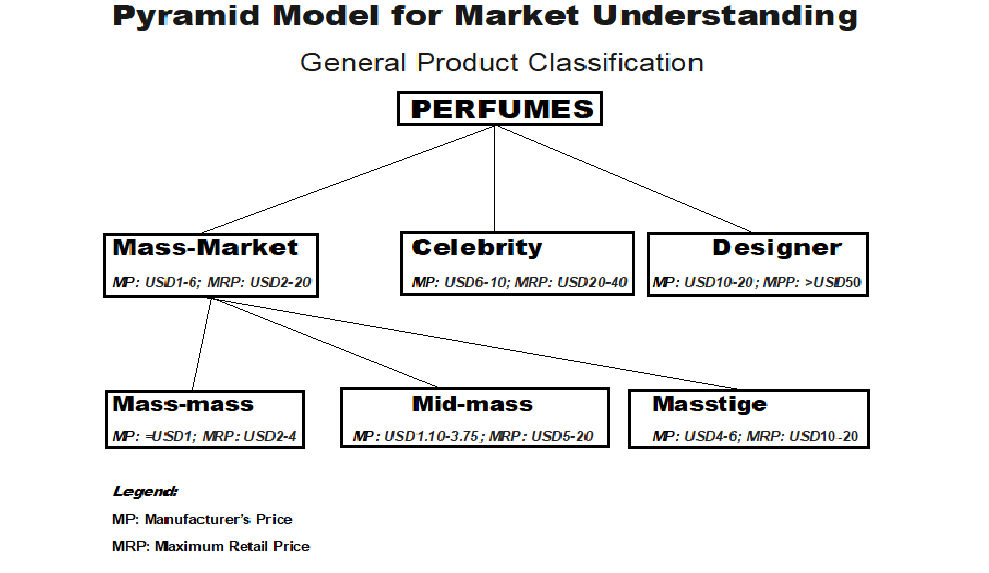

General Product Classification: Using price factor, the model classifies perfumes into three types: Mass-market perfume, Celebrity perfume and Designer – also called Branded/Luxury/Premium – perfume, with the Mass-market further divided into three sub-slots of Mass-mass, Mid-mass and Masstige. Mass-market perfumes have Manufacture’s Price, M.P., of US$1 to 6 & Maximum Retail Price, or M.R.P., as US$2 to 20; Celebrity perfume: M.P. is in the range of US$6 to US$10 & M.R.P. of US$20 to US$40; and Designer perfume: M.P. of US$10 to 20 & M.R.P. of US$50 to US$100 and above. The price indicators within the Mass-market perfume: Mass-mass: M.P. of less than or equal to US$1 & M.R.P.of US$2 to 4; Mid-mass: US$1.10 to 3.75 & M.R.P. of US$5 to 20; and Masstige: M.P. of US$4 to 6 & M.R.P. of US$10 to 20. The range of M.R.Ps. within the same type is an indication of the differences in import duty, Value Added Tax and other tariff among different countries and of M.Ps. tells the flexibility in deciding the quality of various product attributes. Furthermore, the interface of prices represents sales overheads like distribution costs in varying degrees across the markets. For example, in Brazil the combined duties come to 200% of Cost and Freight, or CFR, value for perfumes while there is no import duty for perfumes in Singapore, with the only tariff being 7% VAT. Cost of distribution in sub-Saharan Africa, barring Kenya and South Africa, is lesser as the lion’s share of sales is through the traditional channels while modern-trade plays a bigger role in Latin America and South East Asia. It is very important for a marketer to understand in which type or sub-slot his/her product belongs to because without such an understanding, a marketer will not be successful to decide the right brand or mix of brands for a market, besides, being in dithering on the kind of prospects to hunt for. The classification is illustrated in the following diagram:

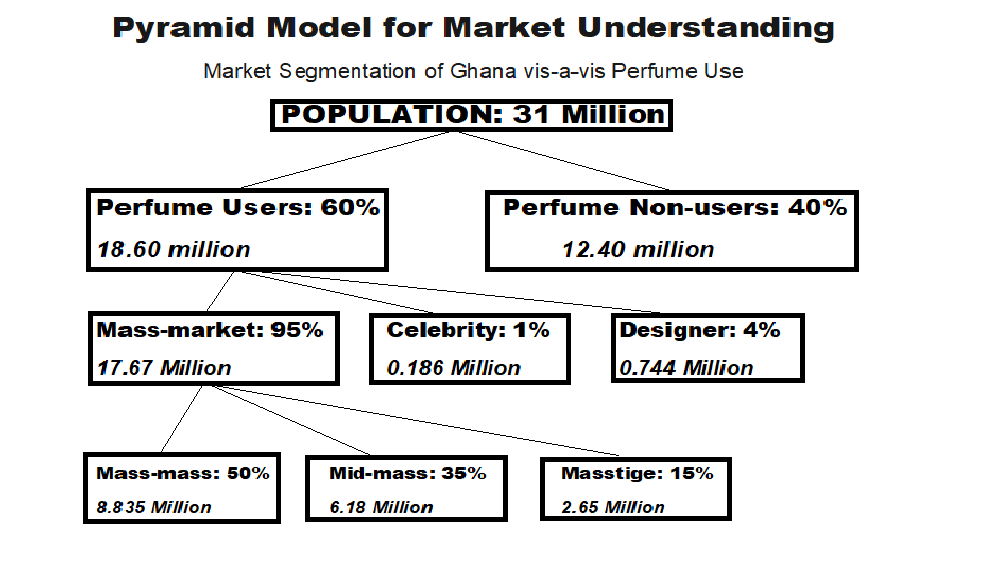

Market Segmentation: It is a conventional straight-line that the size – the potential demand for a product – of a market is the sum total of the demands of its different consumer segments. Hence, a marketer needs to develop a good idea about the various consumer segments of the market he/she operates. Let us take the Republic of Ghana, a West African country, as an illustrative example for quantifying the demand potential of a product, say, perfumes in a country. Ghana has a population of 31 million people. Based on my experience that encompasses interactions with importers, distributors, wholesalers, retailers, consumers, shipping companies and various other players in the trade as well as scooping up information from internet and referring research reports of the perfume trade by various agencies, I guesstimate that 60% of the Ghana population uses perfumes. That gives 18.60 million users of perfumes in Ghana. I zeroed in on 60%, which still has scope for further fine-tuning, after umpteen deliberations and thinking over a long period of time. A marketer can conjure up such data using consultative and deductive skills. The 60% is not a fixed datum and can change in tandem with the overall economic changes in Ghana. Also, the number of perfume users in a country varies depending upon many other cultural and macroeconomic factors.

Ghana is a sub-Sharan country with an average per capita income of US$1800 which boils down to US$150 per month. Most sub-Saharan countries have more or less same per capita income. Sub-Saharan Africa constitutes 49 countries after excluding the five North African countries from Africa. One striking factor in the income distribution of sub-Saharan Africa is that middle income group, unlike in the developing countries, is not significant in size – one is either very rich or abject poor, with a relatively smaller middle class bridging in between.

Despite this distorted income distribution, sub-Saharan Africa is a big market for perfumes. I know you have a doubt: How can perfumes, a sign of luxury, have such a big market in a poor continent? Well, hundreds of years of colonialism had largely transformed the African way of living into the European style. A police man having US$150 monthly salary or a maid earning US$100 per month or a manager earning US$400 is willing to spend US$5 or US$10 to buy a perfume and smell good because perfume is a part of his/her daily life, just like coconut hair oil for the Keralites or paan – betel leaf – for a sizable population of Indians. A Keralite may not spend ₹500 – US$6.66 – on a perfume but will do so for a coconut hair oil because he/she considers perfume as a luxury while coconut hair oil is a part of the lifestyle. A paan user might dish out a similar amount over a period of two months to savour Paan but not on perfumes for the same reason as a Keralite does. Similarly, an African may not spend US$5 or US$10 on hair oil or paan as it is either a luxury or not a part of his/her lifestyle but will spend on perfume because it is a part of his/her day-to-day life.

Such a lower per capita income makes the share of Mass-market perfumes disproportionately higher in Ghana and sub-Saharan Africa. Thirteen years of my interactions with different perfume markets across the globe gave me a few interesting insights into type-mix of various markets with respect to perfumes. Mass-market perfumes form around 95% of perfumes sold in sub-Saharan Africa, with Celebrity perfumes and Designer perfumes forming 1% and 4% respectively. In Hong Kong and Singapore, the Designer perfumes hold 18 to 20% share while in Chile it is around 15%. My Peruvian client told me Mass-market perfume has 65% market share within the perfume market, with Celebrity type having 25% and Designer 10%. Designer perfumes have around 30% share in Western Europe, but its number falls to 10 to 15% in Central and Eastern Europe. In U.S.A., the richest country in the world, Mass-market perfume holds somewhere between 50 to 60% market share. Further insight into the Mass-market type of perfumes reveals, as I experienced across the markets, its rough breakdown into 50% Mass-mass, 35% of Mid-mass and 15% of Masstige.

Coming back to Ghana, 95% of 18.60 million perfume users will bring the number to 17.67 million Mass-market consumers, 1% of Celebrity perfume users to 186,000 consumers and 4% of Designer perfume users to 744,000 consumers. Let us get into sub-slots of Mass-market: Mass-mass of 50% coming to 8.835 million users, Mid-mass of 35% coming to 6.18 million consumers and Masstige segment of 15% making the number of 2.65 million consumers.

Market Segmentation of Ghana:

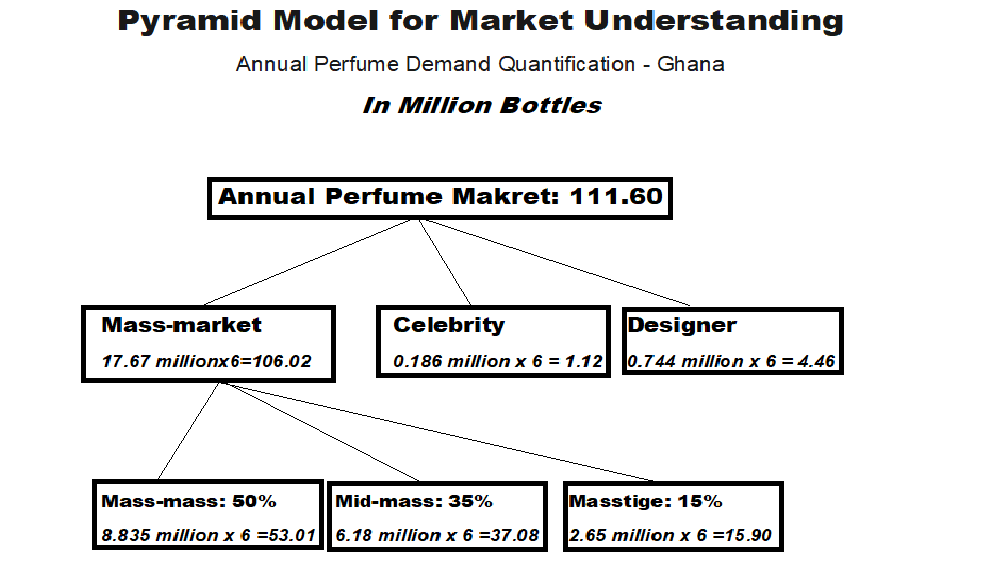

Quantification of Demand: Suppose that a Ghanaian consumes a 100 ml perfume in 2 months, then she/he uses 6 perfumes in an year. So we can quantify each segment as follows:

Mass-mass: 8.835 million x 6 bottles = 53.01 million bottles per annum.

Mid-mass: 6.18 million x 6 bottles = 37.08 million bottles per annum.

Masstige: 2.65 million x 6 bottles = 15.90 million bottles per annum.

Celebrity : 186,000 x 6 bottles = 1.12 bottles per annum.

Designer: 744,000 x 2=6 bottles = 4.46 million bottles per annum

Annual perfume market of Ghana: 106.02 million bottles.

Annual Mass-market perfume market of Ghana: 111.60 million bottles

I am selling Mass-mass, Mid-mass and Masstige brand perfumes. From the above quantification, I get an idea that our Mass-mass brand ‘Nuvo’ has a potential market size of 53.01 million bottles per annum and Mid-mass brand ‘Chris Adams’ has 37.08 million bottles in Ghana. Furthermore, Ghana offers a market size of 15.90 million bottles per annum for a few collections of perfumes in our Masstige type. With these information, I am in Ghana to find a distributor for the brands. How do I go for it? One pertinent question that arises is how one will have all these information if one is going to Ghana for the first time. Well, you can still have sizable information to prepare the Pyramid Model by getting the details from different publications and trade news.

The model can be used to classify and quantify demand for any product under FMCGs: toilet soap, ketchup, toothpaste, etc.; Consumer Durables like cars, television, washing machine, furniture, etc.; Industrial Products: medical equipment, cement, bus, etc.; and Concept products: interior designing, insurance, etc. You will find different price-points for each of these products to fit into the three types and sub-slots of the PMMU. In some cases, number of price-points can increase or decrease the types and sub-slots for a product. In other words, the PMMU model can be applied to any product. All the numbers used in the illustration of the model are guesstimates based on the experience, and although demand estimation through this model does not give accurate data, it will definitely give a marketer a fairly good idea about knowing the product one handles and its market potential, besides, giving a comfortable platform to confront difficult issues like where the brand stands in terms of market share, annual growth plans, performance versus competitions, etc.

Tackling New Market: In-country prospecting leading to a rendezvous with the prospects is detailed in this module.

In-country Prospecting begins on the very day of arrival in a country by collecting information about locations of wholesale markets, supermarket chains, and other stores where your category of products is sold. By picking up conversation with hotel staff, you can collect some of these information. Another source of information is shipping and forwarding companies. Also, it is important to get information about the safety and security of moving around in the city. If you see many policemen on roads, it is an indication that there is some safety issue in moving around. If police are armed, then the risk is higher. On the other hand, it is also an assurance of security.

It is logical to begin the first working day with visits to a few retail shops to get an idea about the competing products that are being sold, prices, etc. There are many countries where rules mandate that importer’s name and address should be mentioned on the product packaging. If you get such information from retail stores, then the doors to your potential clients are straightway open before you. You can also talk to counter sales staff and collect information on the suppliers of such products.

Visit to wholesale markets can fetch you more information as most importers and main distributors have shops there. Hence, if you spend a few hours at wholesale market, it is highly likely that you will come in contact with importers of your competitors’ products or the same-channel products. So by the end of the first day, you will have a list of real-potential clients. It is also possible that the list keeps expanding by the second or third day of your stay because it can be an ongoing process as your stay progresses in the country. In this way, you keep contacting and firming up meetings with more prospective clients as and when more relevant information come your way.

Deal or No Deal: It is not smooth sailing as it might seem from what I scribbled above. You may get a contact but it can say no to meeting; if meeting happens, another round of meeting can be fixed, which in turn can lead to a third meeting with or without a favorable result at the end; intervening periods between meetings can be of anguish and agony; frustration can creep in; disappointment from the failure to close a deal; ecstasy of a successful deal; and so on. The time you spend in a virgin market will be a mixed bag of these ups and downs. You will either succeed to close a deal or understand that a deal is not possible because of business reasons or return with a realization that a deal is possible on further follow up or during a next visit with better preparations. While success is not guaranteed on your maiden visit to a country, you will definitely be richer for the experience.

I would like to thank you for sharing your experience with us. Good luck & all the best 👍

LikeLiked by 1 person